Forex trading has changed drastically in the last 10 years. Artificial intelligence is replacing what was originally done using human intuition, charts, and manual calculations. As the AI trading platforms are emerging, a significant question is being posed by the traders across the globe:

Is AI trading really better than traditional trading- or is the human touch unconquerable?

We discuss the pros and cons of each style as well as real-life example applications in this ultimate guide to help you determine which one is more suitable. You are a novice looking at the best platform for online trading or an advanced trader looking at the automation, and you need to know all the details that are available in this article.

Learning the Traditional Trading of Forex

The Human-Centric Approach

The practice of traditional trading is very dependent on human decision-making. Traders study charts, monitor news on the market, examine economic indicators and make trades manually. This method is flexible, innovative and subjective, which machines can not fully imitate.

Benefits of Traditional Trading

Emotional Intelligence: Machines are not as effective in comprehending context, tone, and sentiment as human beings are during significant geopolitical occurrences.

Experience-Based Decision-making: Seasoned traders can identify chart patterns and market behaviour that cannot be detected using algorithms.

Control and Intuition: There are traders who like to control everything, particularly in the case of the best forex trading platform to apply discretionary trading tactics.

Weaknesses of Conventional Trading

Although it has its strong side, there are limitations to traditional trading:

- Emotional biases may result in overtrading or revenge trading.

- Delays in responding as opposed to automated systems.

- Lack of ability to track several markets at a time.

- Demands and takes a lot of time, practice and discipline.

Due to such constraints, traders are also turning to the use of the AI trading platforms to enhance trade performance and minimise mistakes.

Forex AI Trading: The New Era

How AI Trading Works

AI trading is a type of trading that operates on algorithms, machine learning models, predictive analytics and data-driven tools to analyse the markets and trade. These models can compute thousands of data points in milliseconds, which would not be possible manually by human beings.

Advantages of AI Trading Page

- Fast and Accurate: AI trades instantly and with fewer errors.

- Emotion-Free Trading: AI does not fear, does not greed, and is not impulsive.

- Mass Data Analysis: The machine models are used to analyse past data, news sentiment and volatility trend among others.

- 24/7 Surveillance: Forex markets operate 24 hours, and AI will not allow any opportunity to pass unnoticed.

- More Optimisation: With most systems, it is a continual learning curve, and they become better over time.

This is the reason why most analysts believe that AI trading platforms are the future and can even be the best platform for online trading, depending on the intentions of a trader.

Limitations of AI Trading

AI trading is not flawless. Some challenges include:

- Reliance on proper model tuning and good-quality data.

- Exposure to unforeseen political upheavals.

- Should have effective risk management and monitoring.

- Efforts to purchase sophisticated systems over some platforms.

The limitations however, can be reduced when combined with a robust human supervision.

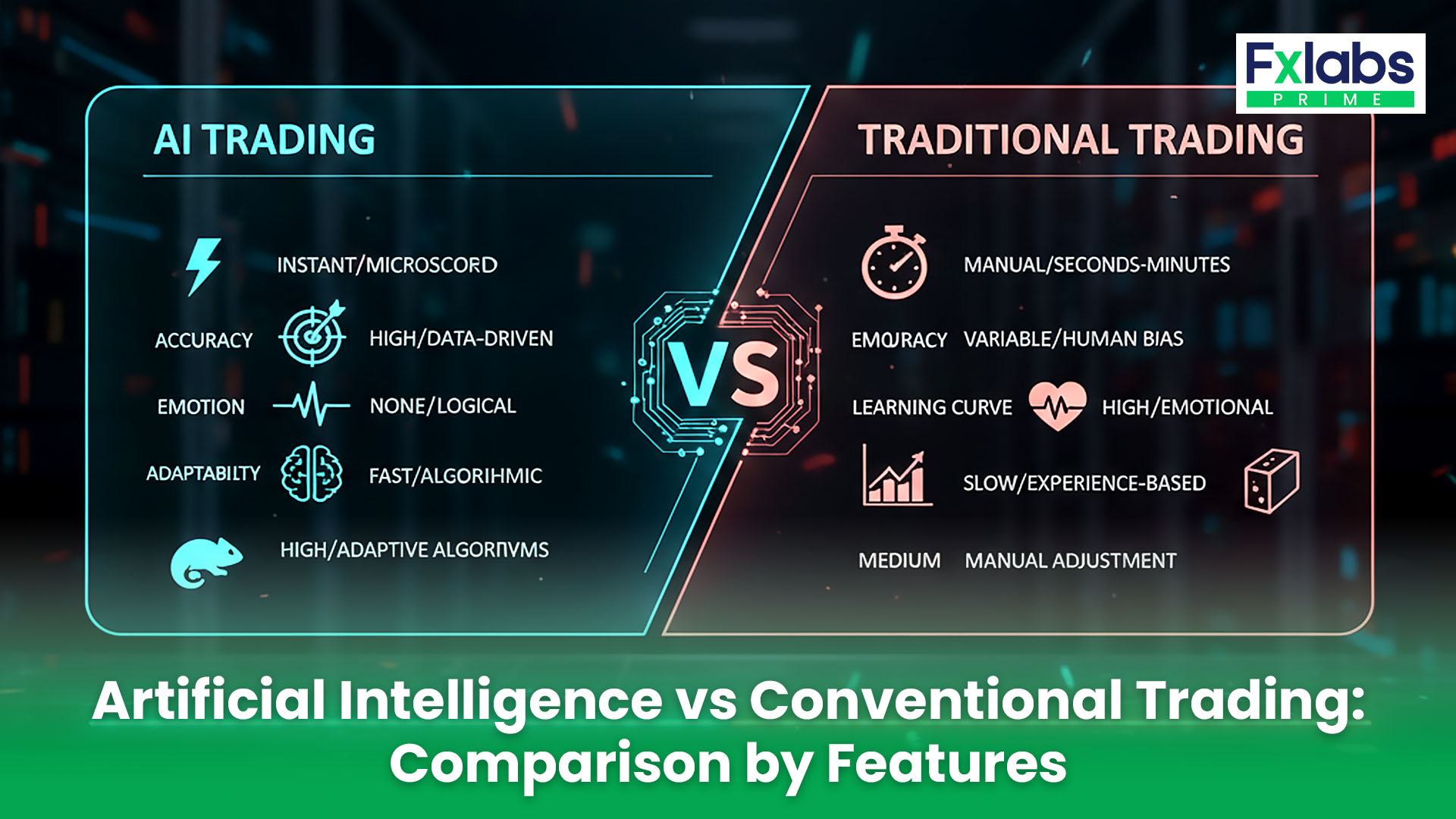

Artificial Intelligence vs Conventional Trading: Comparison by Features

Accuracy and Predictive Power

Data-based analysis is evidently in favour of AI. Conventional trading is based on experience and is unable to compete with real-time predictive modelling.

Speed and Execution

AI is much faster in order execution, so it is better used in scalping or high-frequency strategies. Performances may be missed due to manual implementation.

Emotional Discipline

The issue of discipline is common amongst traditional traders. The AI is less emotional and can be considered more consistent.

Adaptability

Humans excel in unforeseen situations where they have to make judgments and context. AI is most effective in organised settings that have quantifiable trends.

Learning Curve

Conventional trading takes months or years to learn. Entry-level access is made easy with AI platforms, thus appealing to beginners looking for the best forex trading platform.

Which Is Better for Forex Trading?

The actual solution may lie in your objectives of trading, risk tolerance, and trading style.

AI Trading Is Better For:

- Traders seeking comfort and speed.

- People who are in no position to physically monitor markets.

- Novices that require setup, automated help with the help of artificial intelligence trading software.

- Investors who want scalable strategies in the best platform for online trading.

Traditional Trading Is Better For:

- Experienced, intuitive, manual control traders.

- Fundamental or sentiment-based investors.

- Traders who like analysis, charting and researching the market.

The Hybrid Approach: The Best of Both Worlds

Hybrid models have become prevalent with most advanced traders:

- AI does monotonous work and analysis with high data.

- Man is the one who makes the final decision, particularly in volatile situations.

This is considered to be the most workable and stable method and is becoming very popular among the best forex trading platform providers.

How to Select the Most Appropriate Platform in Online Trading

There are hundreds of platforms to choose from, which is why it is hard to decide which one is appropriate. These are the things you are supposed to seek:

Key Features to Consider

Artificial intelligence assistance or automation.

Intelligent signals- smart indicators, technical analysis.

Fast trade execution

User-friendly dashboard

Good risk management tools

Availability of international foreign exchange.

It doesn’t matter which you give priority to, human or automation; it is important to choose the best platform for online trading, which would be successful in the long run.

Conclusion: AI or Traditional Trading?

The current forex market is a busy and dynamic one, and AI has certainly transformed the trading market. Its capacity to handle large volumes of data, remove emotional as well as any type of biases and operate trades in an optimal timing makes it superior in several ways compared to traditional trading.

The old trading is however not a useless thing- particularly to those who believe in intuition, sentiment, or high-experience judgement. The fact is that there is no best option.

The best mode is subject to the trader in question. To the majority of contemporary traders, a combination model with the assistance of the most optimal forex trading platform can have the most effective outcomes.

The most important thing is to select a platform that will enable you to make smarter and more profitable forex trading decisions, whether by automating AI or providing more powerful charting software or by providing convenient functionality.